Benefit of Saving vs. Borrowing for College

the current cost of college often exceeds $25,000 per year

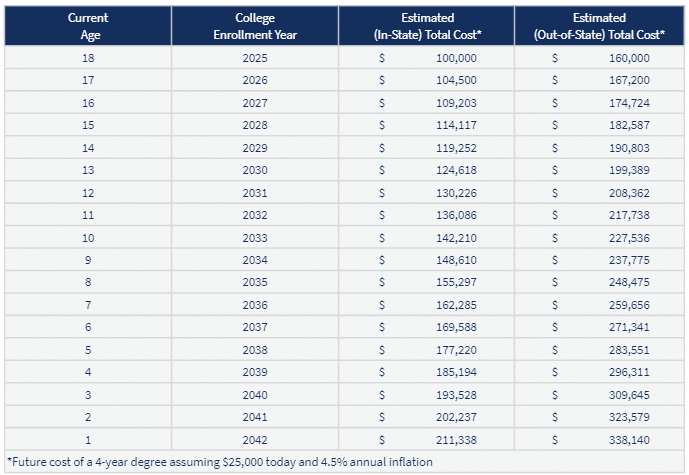

So the question is, how much will college cost for your student? If we assume a 4-year degree can exceed $100,000 in 2025 and that the future cost will rise by an average of 4.5% per year, take a look at the table to see what the expense may inflate to over time.

Which choice would you prefer to pay for the rising cost of college?

Option 1: Save

- Save $250/month for 18 years in a 529 Plan with a hypothetical growth of 6.5%

- Total contributions: $54,000

- Tax-deferred growth & tax-free distributions for qualified expenses

- Contributions may be eligible for a state tax deduction

- Future value: $102,085

- Potential benefit from investment growth & tax deduction: $50,785

Option 2: Borrow

- Take out a loan for $102,085

- Hypothetical loan terms: 10 years at 6.5% interest

- Estimated monthly payment: $1,159

- Total repayment over 10 years: $139,098

- Total interest paid: $37,013

- Significant financial burden after graduation for the student or parents

- Potential impact on credit score and future borrowing capacity

comparing the two options

- The potential financial benefit of saving over borrowing is over $87,000.

- Excess savings may also be eligible to roll to a Roth IRA for the student or designated to another student.

how strongbox wealth can help

We work with families to design personalized college savings strategies that fit into their broader financial picture by:

- Balancing college savings with retirement plans, emergency savings, and lifestyle goals

- Integrating tax strategy and estate plans to the overarching financial plan

- Implementing an investment strategy aligned with liquidity needs, time horizon, and risk preferences

let us help you turn today’s savings into tomorrow’s opportunities

StrongBox Wealth, LLC is a Registered Investment Adviser. This brochure is solely for informational purposes. The views reflected here are subject to change at any time without notice. Nothing in this brochure constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person or entity. Advisory services are only offered to clients or prospective clients where StrongBox Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing in securities involves risk and possible loss of capital. No advice may be rendered by StrongBox Wealth, LLC unless a client service agreement is in place.