We listen to your financial objectives as our first step taken together. We understand your concerns about investing, retirement income, asset preservation, and wealth transition. With clarity and resolve, we advise you by crafting and implementing a uniquely customized plan best suited to align with your priorities. As your life’s journey evolves, we safeguard your best interests by walking beside you to guide the way.

Everything we offer is customized to align with your needs, your goals and your values. We apply the invaluable insights and comprehensive strategies derived from over 35 years of investment management experience to create just the right solutions for you.

Because all investing involves some form of risk, and every person has a varying level of comfort with it, we emphasize to clients the importance of understanding, balancing, and mitigating risks where possible.

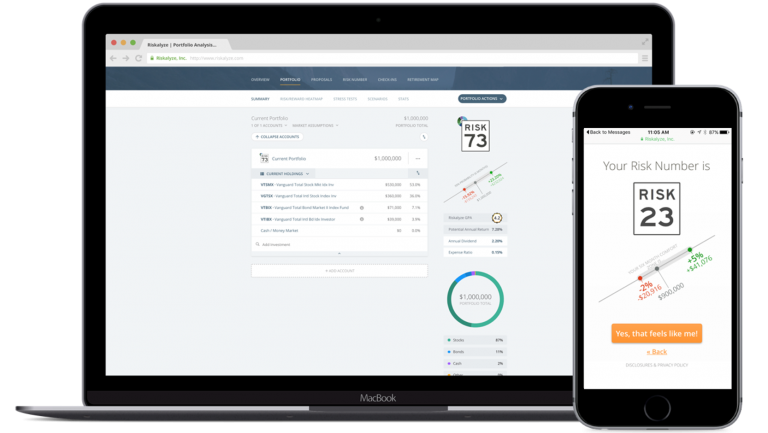

We take a quantitative approach to pinpointing your “Risk Number” by going through a series of objective exercises based on actual dollar amounts.

If you already have an investment portfolio, we can quickly import it to see if your customized “Risk Number” aligns with how your investments are actually allocated.

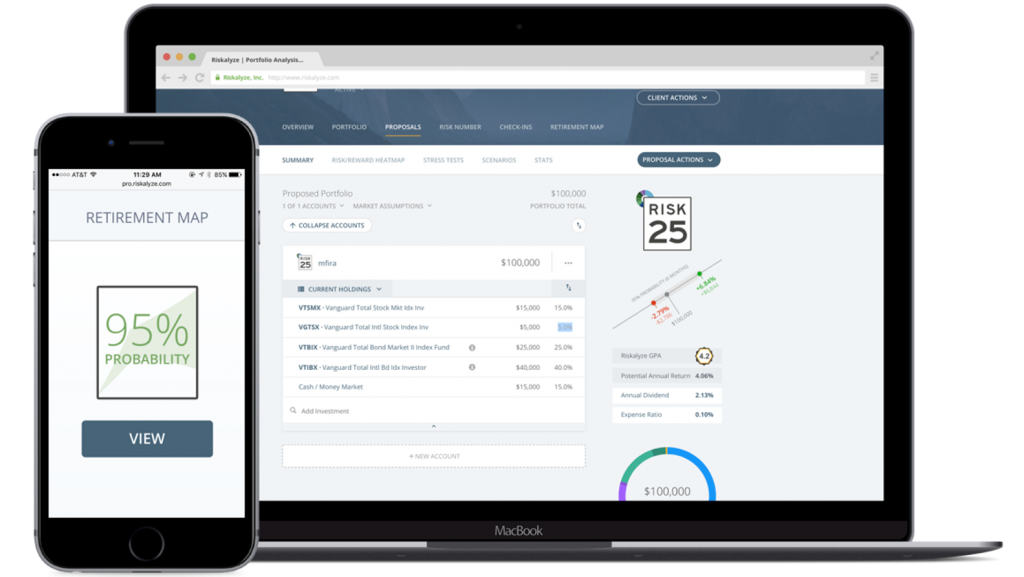

How much should you have?

We’ll use all these factors to tailor an efficient investment portfolio design that better aligns with your risk tolerance and goals. We then stress test your revised portfolio prior to implementation and discuss your probability range that details potential performance range over a six month time period with a 95% degree of confidence.

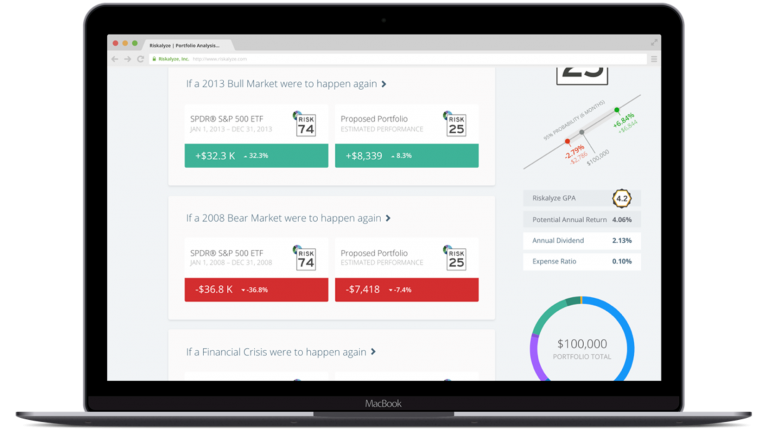

But, what if...

Don’t worry; we will also stress test your portfolio against historic market conditions like the bear market of 2008, the bull market that followed, and illustrate the effects that a potential rise in interest rates could have on your accounts and plan. These stress tests help set realistic expectations and often provide peace of mind that you are invested appropriately.

How much do you need?

We may find a reduction in portfolio risk is in order and doing so may actually improve your desired outcome. Together, we’ll craft a customized financial plan and portfolio strategy as unique as your story and adjust as needed every step of the way.

Determining how fast you’re comfortable traveling on your investment journey is the first step in helping your advisor develop an investment strategy that’s right for you.

Everyone has a Risk Number.

lET’S FIND YOURS.

Send us a message