Municipal Bonds – The Merit of Tax-Free Income

Why Consider Municipal Bonds?

Municipal bonds (“munis”) are debt obligations issued by state and local governments or their agencies to fund public projects such as schools, highways, and infrastructure. These fixed income securities provide investors with a unique combination of tax free fixed income and capital preservation.

Key Benefits of Municipal Bonds

Tax-Free Income: Interest earned on most municipal bonds is exempt from federal income tax and, in many cases, state taxes, providing investors with a potentially attractive after-tax yield.

- Reliable Income Stream: Munis offer consistent semi-annual interest payments, making them a valuable source of steady investment income.

- Preservation of Capital: High-quality municipal bonds, particularly those with top investment- grade ratings, are known for their creditworthiness, historically low default rates, and principal preservation.

- Diversification Benefits: Municipal bonds serve as a conservative allocation within a diversified investment portfolio, potentially reducing overall portfolio volatility.

- Community Impact: Muni investing finances essential public services and infrastructure projects, supporting local communities

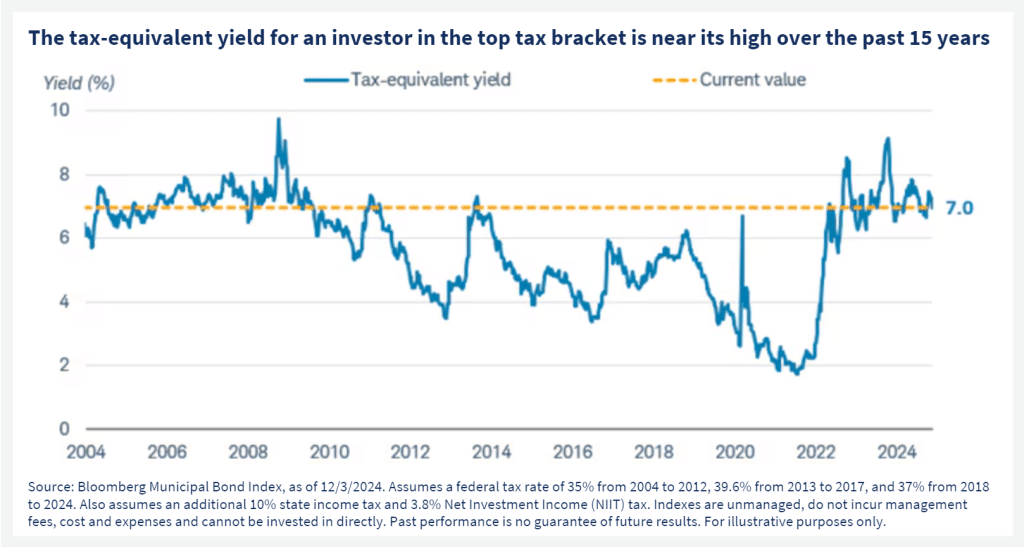

2025 Tax-Equivalent Yield Comparison Chart

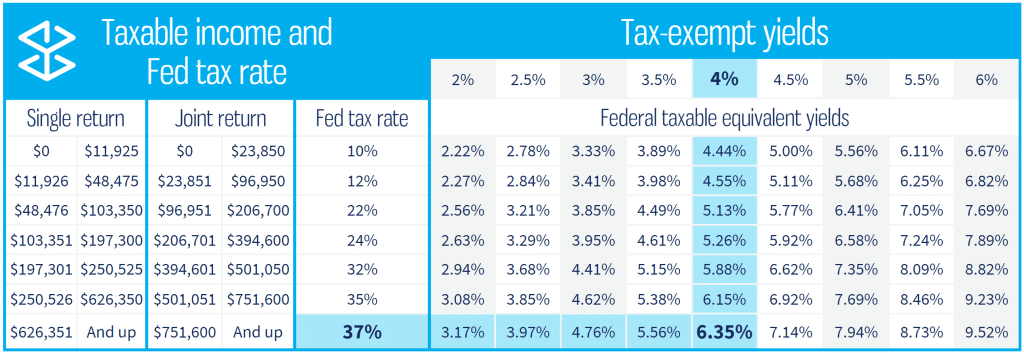

One of the most compelling reasons for high effective tax rate investors to consider municipal bonds is understood by illustrating the importance of one’s tax-equivalent yield (TEY). Since municipal bond interest is exempt from federal taxes, it may result in a higher net return compared to taxable investments, even if those taxable investments offer a higher gross interest payment. See below for a visual representation of how tax-equivalent yields compare at various tax rates.

Understanding Tax-Equivalent Yield (TEY) Formula TEY = Municipal Bond Yield / (1 – Tax Rate)

For example, if an investor is in the 37% federal tax bracket and holds a municipal bond paying a 4.00% coupon, the tax-equivalent yield is calculated as:

4.00% / (1 – 0.37) = 6.35%

This means that, on a tax-adjusted basis, the investor would need to earn at least 6.35% on a taxable bond to achieve the same after-tax return as a 4.00% tax- free municipal bond. The chart below illustrates that tax-free yields relative to taxable yields are near 15- year highs and have historically provided high-income investors an opportunity to net a greater investment income yield.

Safety and Credit Quality of Munis

- Low Default Rates: Investment-grade municipal bonds have significantly lower historical default rates compared to corporate bonds.

- Government Backing: Many municipal bonds are backed by the taxing power of the issuing municipality (general obligation bonds) or revenue from specific projects (revenue bonds).

- Bond Insurance and Credit Enhancements: Some municipal bonds are insured or backed by strong credit structures, further reducing risk.

Who Should Consider Municipal Bonds?

Municipal bonds offer a compelling opportunity for

tax-conscious investors. By delivering federally tax-free income with strong credit quality and competitive tax- equivalent yields, they provide a valuable tool for preserving wealth and maximizing after-tax returns.

Municipal bonds are particularly advantageous for:

- High-net-worth individuals in the top federal tax brackets seeking tax-efficient income.

- Investors looking to reduce tax liability while maintaining a conservative fixed-income portfolio.

- Those seeking stable cash flow and capital preservation.